The US Federal Maritime Commission (FMC) has cleared the Premier Alliance, a global shipping […]

The post Smooth seas ahead for Premier Alliance, FMC says appeared first on Offshore Energy.

The US Federal Maritime Commission (FMC) has cleared the Premier Alliance, a global shipping alliance between South Korea’s HMM, Singapore’s Ocean Network Express (ONE) and Taiwan’s Yang Ming Marine Transport Corporation, for take-off.

According to the FMC, the Premier Alliance will start on February 9, 2025. It will allow HMM, ONE and Yang Ming to share vessels and routes in the trades across the Asia-Europe, Transpacific, and Asia-Middle East main trade lanes.

HMM representatives said that Premier would be collaborating with the Swiss colossal Mediterranean Shipping Company (MSC) in the Asia-Europe trade.

Under the terms of the tripartite agreement, HMM, ONE and Yang Ming would not just share vessels or exchange vessel space, but also discuss and agree on the size, number and operational characteristics of the ships, and engage in other related activities “on a global scale”.

The agreement was originally filed for approval with the FMC on October 28, 2024. Although the alliance was supposed to go into effect starting December 12, the FMC reported in early November last year that additional information had to be submitted before a formal nod of approval could be granted.

Due to this, the review process was delayed in order to collect the necessary data, which is used to complete an economic analysis of the competitive side of the proposal.

Related Article

-

FMC halts tripartite Premier Alliance’s debut

Authorities & Government

Finally, The FMC deemed the responses complete on December 26. By law, the commission had a maximum of 45 days to review a newly filed submission or the responses to an RFAI before it would automatically go into effect.

As understood, the Premier Alliance replaces the previous arrangement known as THE Alliance, launched in 2016, as the three Asian companies now gear up to move forward without their former partner, Germany’s shipping heavyweight Hapag-Lloyd.

The green light for the Premier Alliance also comes just days after Hapag-Lloyd’s and Denmark-based titan A.P. Moller-Maersk’s Gemini Cooperation officially came into force.

This long-term operational partnership between the two shipping players was revealed at the beginning of 2024 and – after similar delays with the FMC – received the authority’s go-ahead in September.

The cooperation—for which the companies said 340 vessels would be deployed—formally came into effect on February 1, 2025. As per Maersk, the goal behind this undertaking was to deliver a “flexible and interconnected” ocean network with schedule reliability of up to 90%, predictability and sustainability in mind while covering the main East-West trade routes.

Related Article

As revealed by Copenhagen-based consultancy Sea Intelligence, February 1 signaled the dawn of a new competitive landscape within deep-sea container trades from Asia to North America and Europe.

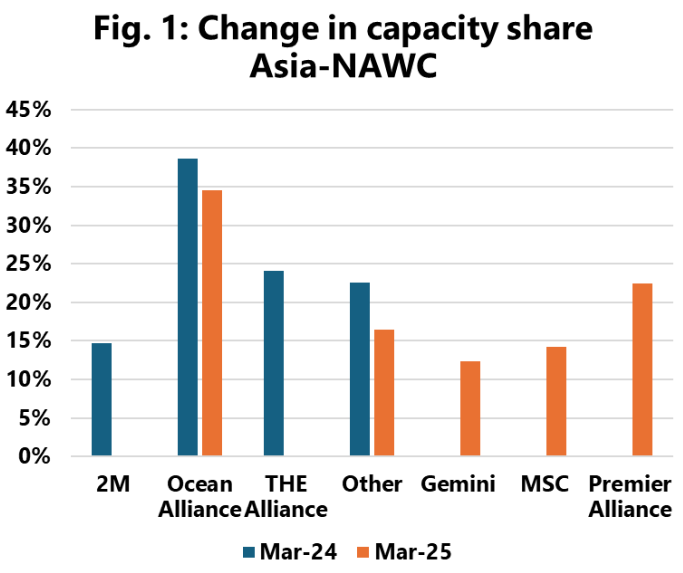

In a February 7 analysis, the Danish consultancy examined the market share of shipping alliances in two different timelines: March 2024 and a vision for March 2025.

Here, they reportedly found a slight loss of market share for Ocean Alliance—the world’s largest operational shipping network established by France’s CMA CGM, China’s COSCO Shipping, Taiwan’s Evergreen Line and Hong Kong’s Orient Overseas Container Line (OOCL)—which was extended in February 2024 for five additional years until 2032.

Sea Intelligence highlighted that the loss had nothing to do with reduced capacity. Instead, the plates have been shifting because other carriers have been injecting capacity at a ‘higher’ pace than Ocean Alliance itself. That said, Ocean reportedly remains the largest partnership, operating 35% of the planned capacity.

Sea Intelligence maintains that the Premier Alliance would maintain the same market share as THE Alliance had. Gemini Cooperation is currently the smallest player in the Transpacific trade, but the consultancy has underscored that the difference between Gemini and Premier is ‘very marginal’, i.e. 0.2 percentage points in favor of the latter.

Content Original Link:

" target="_blank">