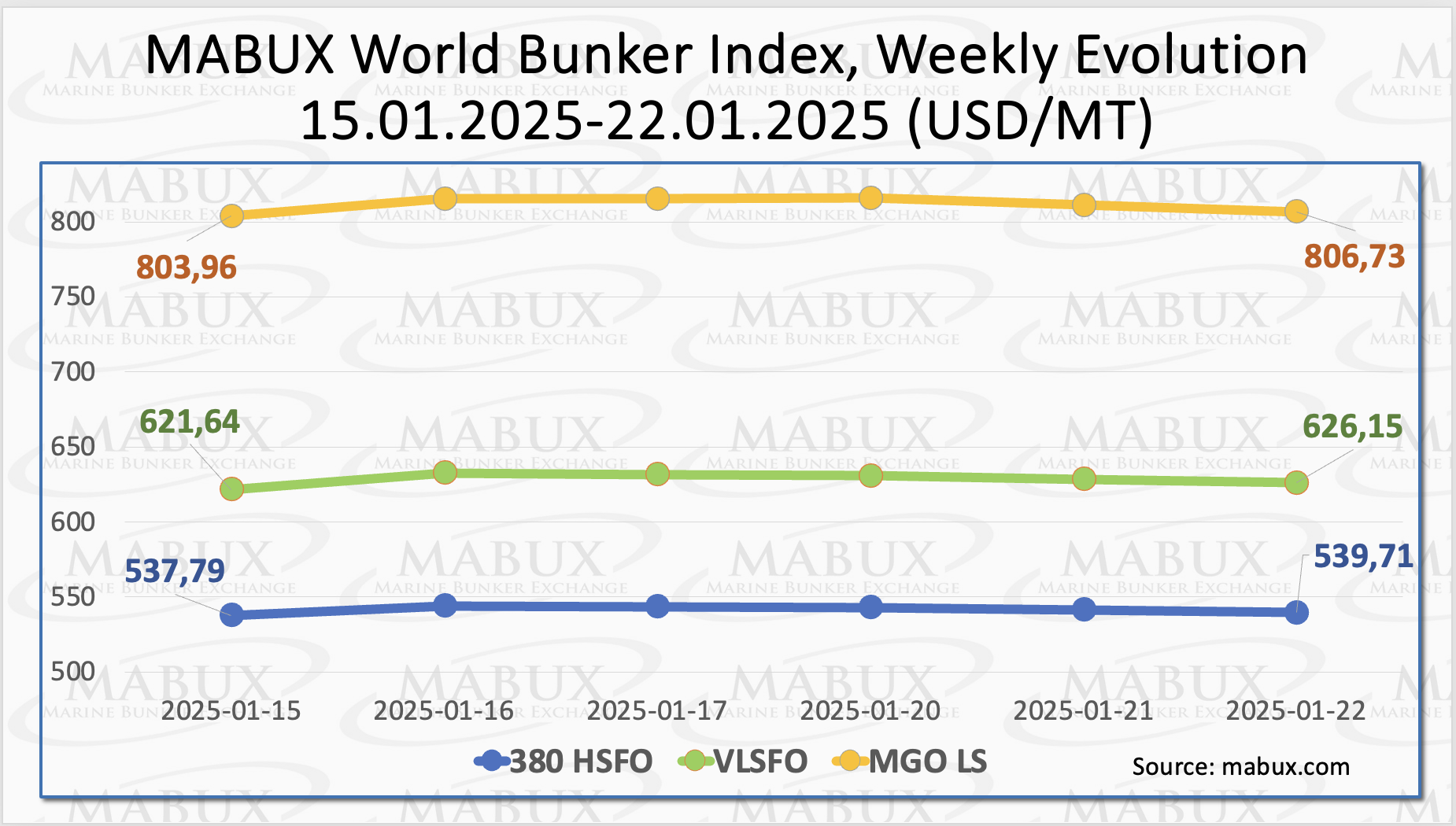

During the fourth week of the year, Marine Bunker Exchange (MABUX) global indices experienced a moderate upward trend.

The 380 HSFO index rose by US$1.92 to US$539.71/MT, the VLSFO index increased by US$4.51 to US$626.15/MT and the MGO index also saw a gain of US$2.77, reaching US$806.73/MT.

“However, as of this writing, early indications of a downward trend in the global bunker market have been observed,” stated a MABUX official.

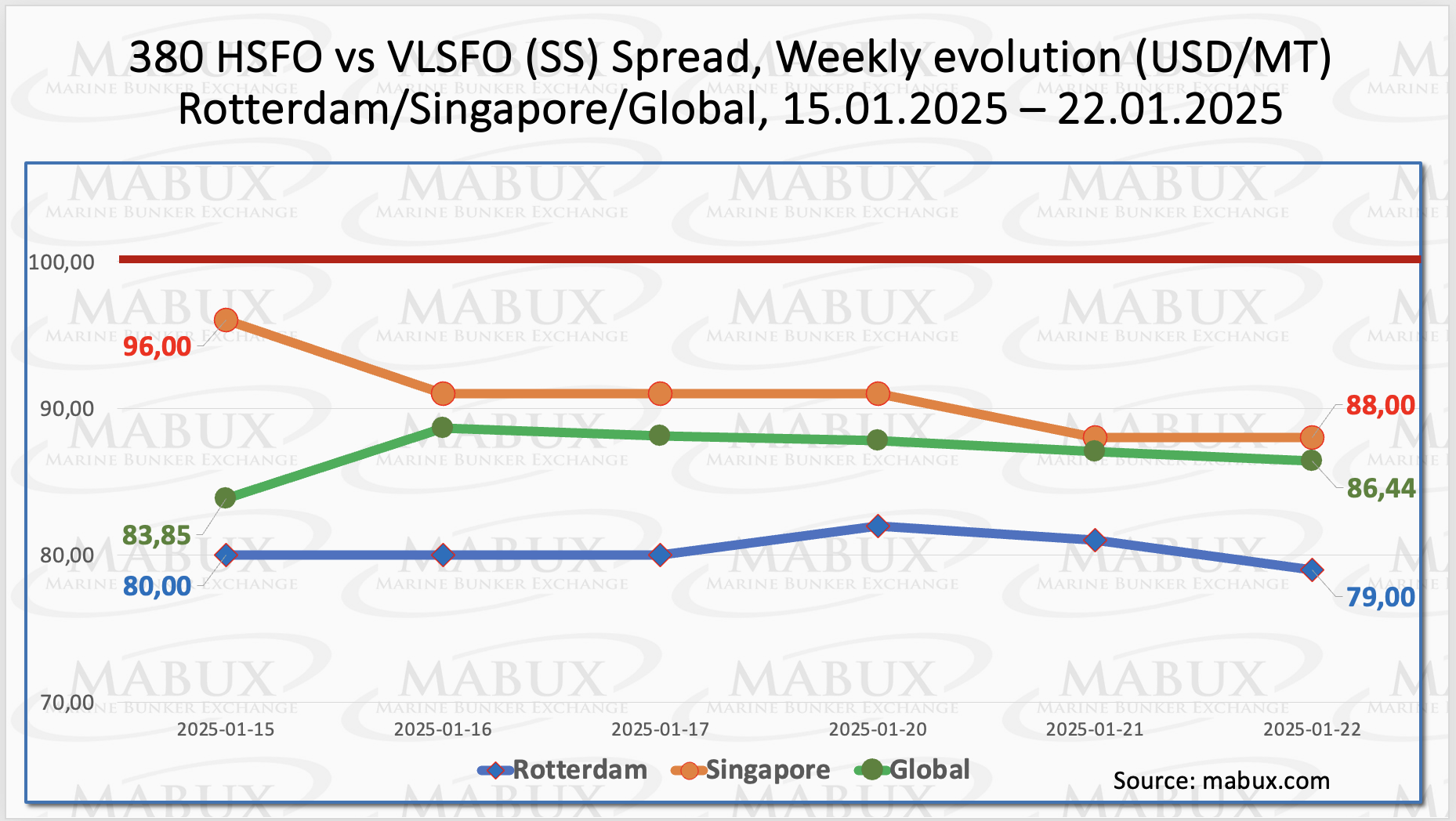

The MABUX Global Scrubber Spread (SS)—the price difference between 380 HSFO and VLSFO—registered a slight increase of US$2.59 to US$86.44. However, it remained below the US$100 breakeven level. The weekly average of the spread grew by US$3.67.

In Rotterdam, the SS spread decreased by US$1.00, from US$80.00 to US$79.00, though the weekly average rose by US$1.00. Conversely, in Singapore, the spread declined by US$8.00, dropping from US$96.00 to US$88.00, with the weekly average falling by US$4.50. Throughout the week, the Global SS Spread and regional indices exhibited no clear trend and consistently stayed below the US$100 threshold.

“We anticipate no significant changes in the SS Spread dynamics next week, with the indicators likely continuing their irregular fluctuations,” commented a MABUX official.

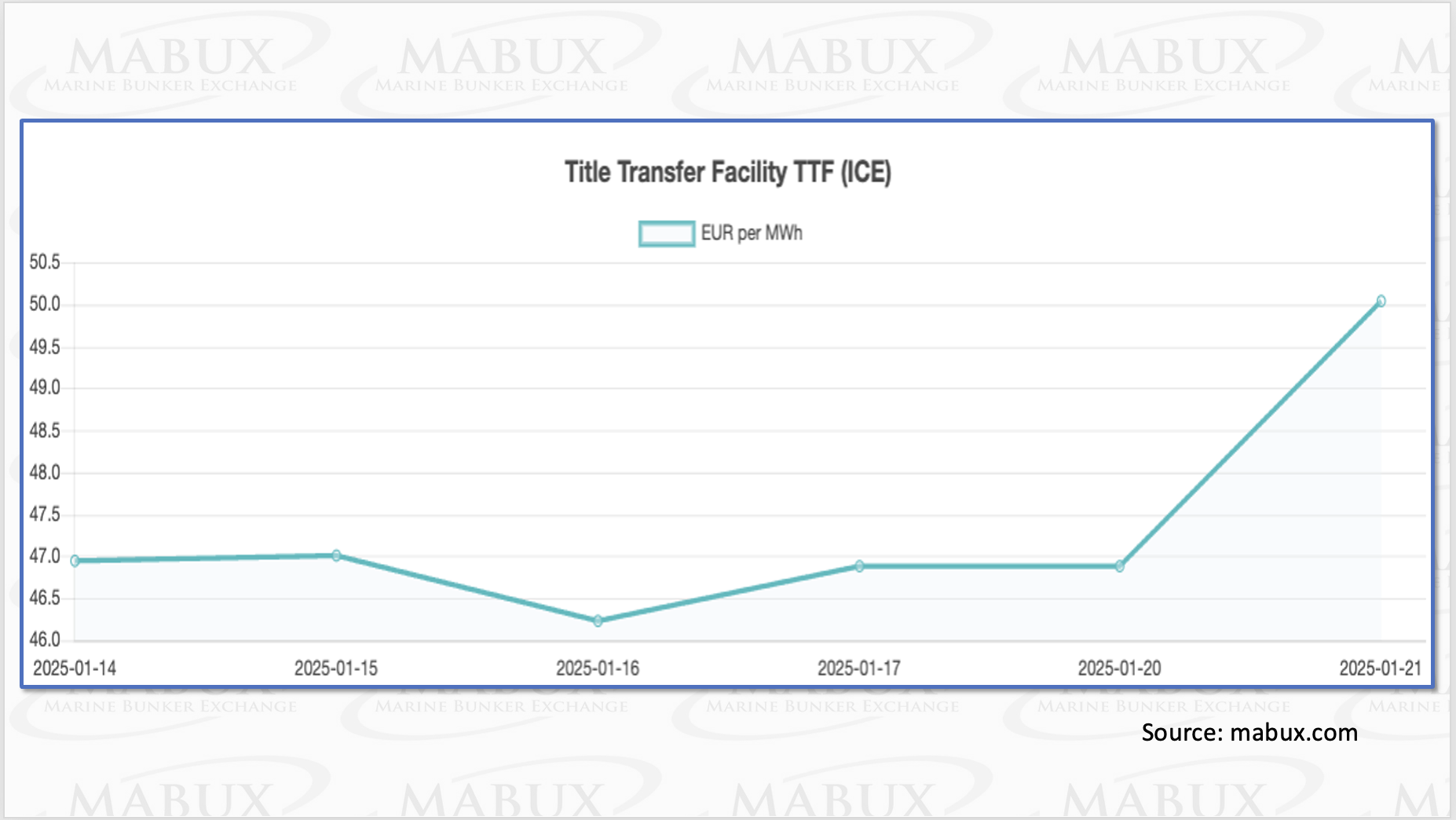

According to MABUX, currently, gas prices, wind power generation, and demand levels show little volatility in the primary European electricity markets. Lower gas prices and increased wind power generation have driven down energy prices in some regional markets while rising demand has pushed prices higher in others. Meanwhile, the natural gas market is expected to remain resilient and experience an upward trend in the medium term.

This is largely attributed to the expansion of global LNG production capacity and the development of import infrastructure, which are solidifying LNG’s role as a key energy source in Europe. As of 20 January, European regional storage facilities were 59.38% full (down 5.60% from last week and down 11.95% from the beginning of the year) and the gas withdrawal process was ongoing. At the end of Week 04, the European gas benchmark TTF rose by 3.08 EUR/MWh, exceeding the 50.00 EUR/MWh mark (50.027 EUR/MWh versus 46.947 EUR/MWh last week).

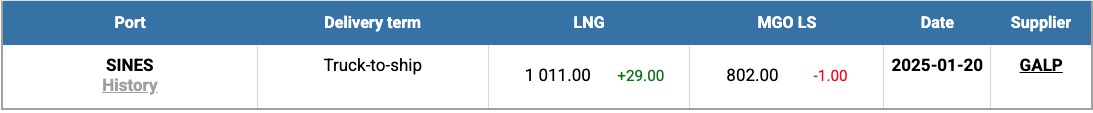

At the port of Sines in Portugal, the price of LNG as a bunker fuel rose by US$29 over the week, reaching US$1,011/MT as of 20 January. On the same date, the price difference between LNG and conventional fuel widened, with MGO LS priced US$209 lower than LNG, compared to a US$175 difference the previous week. MGO LS was quoted at US$802/MT in Sines on 20 January.

During Week 4, the MABUX Market Differential Index (MDI)—which compares market bunker prices (MBP) to the MABUX digital bunker benchmark (DBP)—showed mixed trends across the four major hubs: Rotterdam, Singapore, Fujairah, and Houston.

- 380 HSFO Segment: Singapore moved into the overcharge zone, with its weekly average rising by 6 points. Meanwhile, Rotterdam, Fujairah, and Houston remained undervalued, with underpricing increasing by 36 points in Rotterdam but decreasing by 6 points in Fujairah and 1 point in Houston.

- VLSFO Segment: All ports remained in the undercharge zone. Weekly averages increased by 4 points in Rotterdam, 1 point in Singapore, and 6 points in Houston, while Fujairah saw a 1-point decrease. Singapore’s MDI remained close to a 100% correlation between MBP and the MABUX digital benchmark.

- MGO LS Segment: Singapore returned to the undervalued zone, resulting in all ports being underpriced. Weekly averages increased by 1 point in Rotterdam, 9 points in Singapore, 8 points in Fujairah, and 15 points in Houston. MDI indices in Rotterdam and Singapore remained near the 100% correlation level between MBP and DBP, while Fujairah’s index continued to exceed the US$100 mark.

“We expect a moderate downward trend to resume in the global bunker market next

week,” stated Sergey Ivanov, Director, MABUX.

The post Moderate upward trend observed in global bunker indices appeared first on Container News.

Sidebar

Infomarine.Net Menu

Infomarine On-Line Maritime News

Today Maritime News Worldwide

Infomarine On-Line Maritime News

Today Maritime News Worldwide

24

Fri, Jan