Global bunker indices continue downward trend

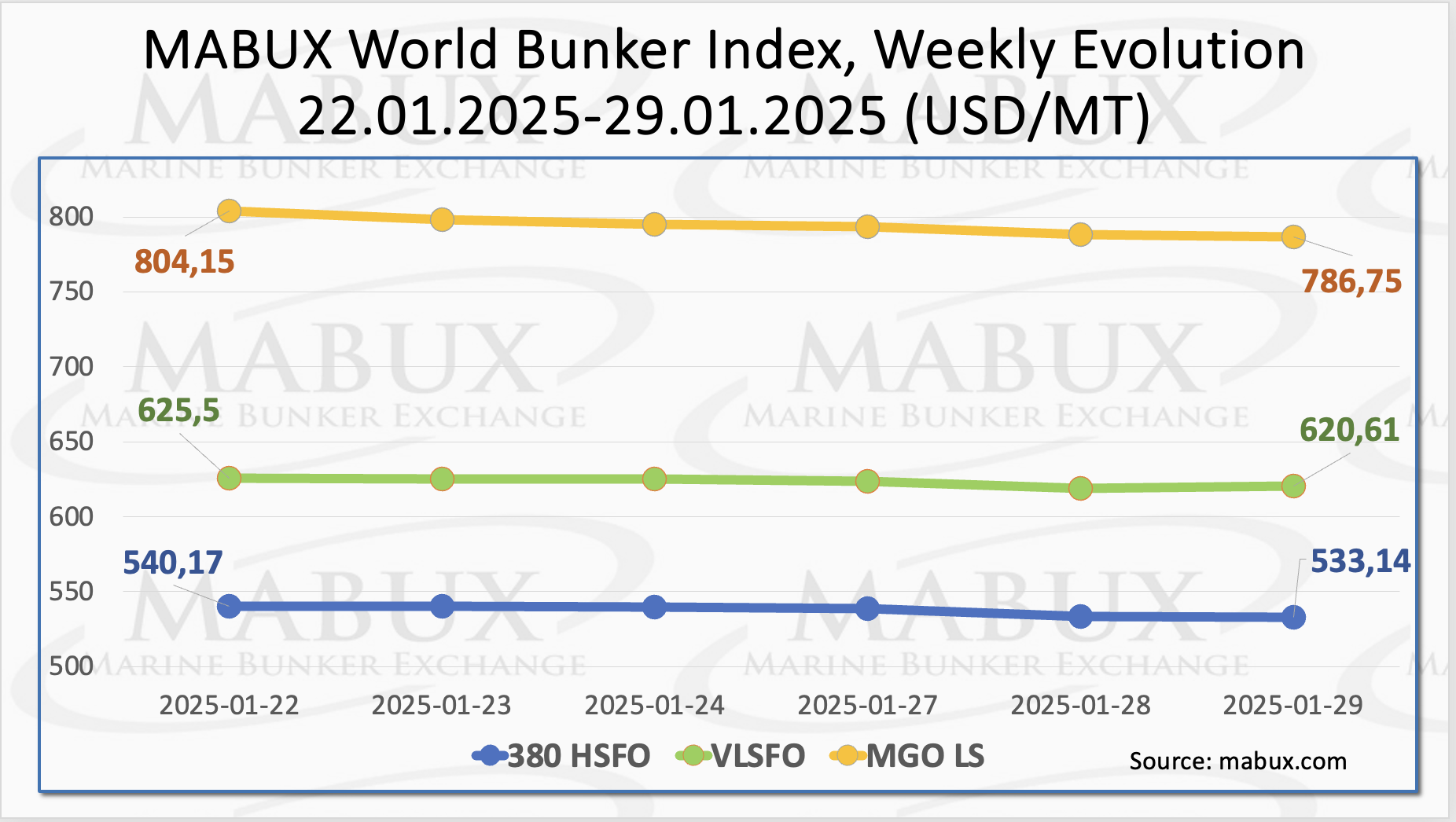

During the fifth week of the year, the Marine Bunker Exchange (MABUX) indices experienced a continuous decline.

The 380 HSFO index dropped by US$7.03 to US$533.14/MT, the VLSFO index decreased by US$4.89 to US$620.61/MT and the MGO index saw a significant decline of US$17.40 to US$786.75/MT.

“At the time of writing, no clear trend was observed in the global bunker market,” said a MABUX official.

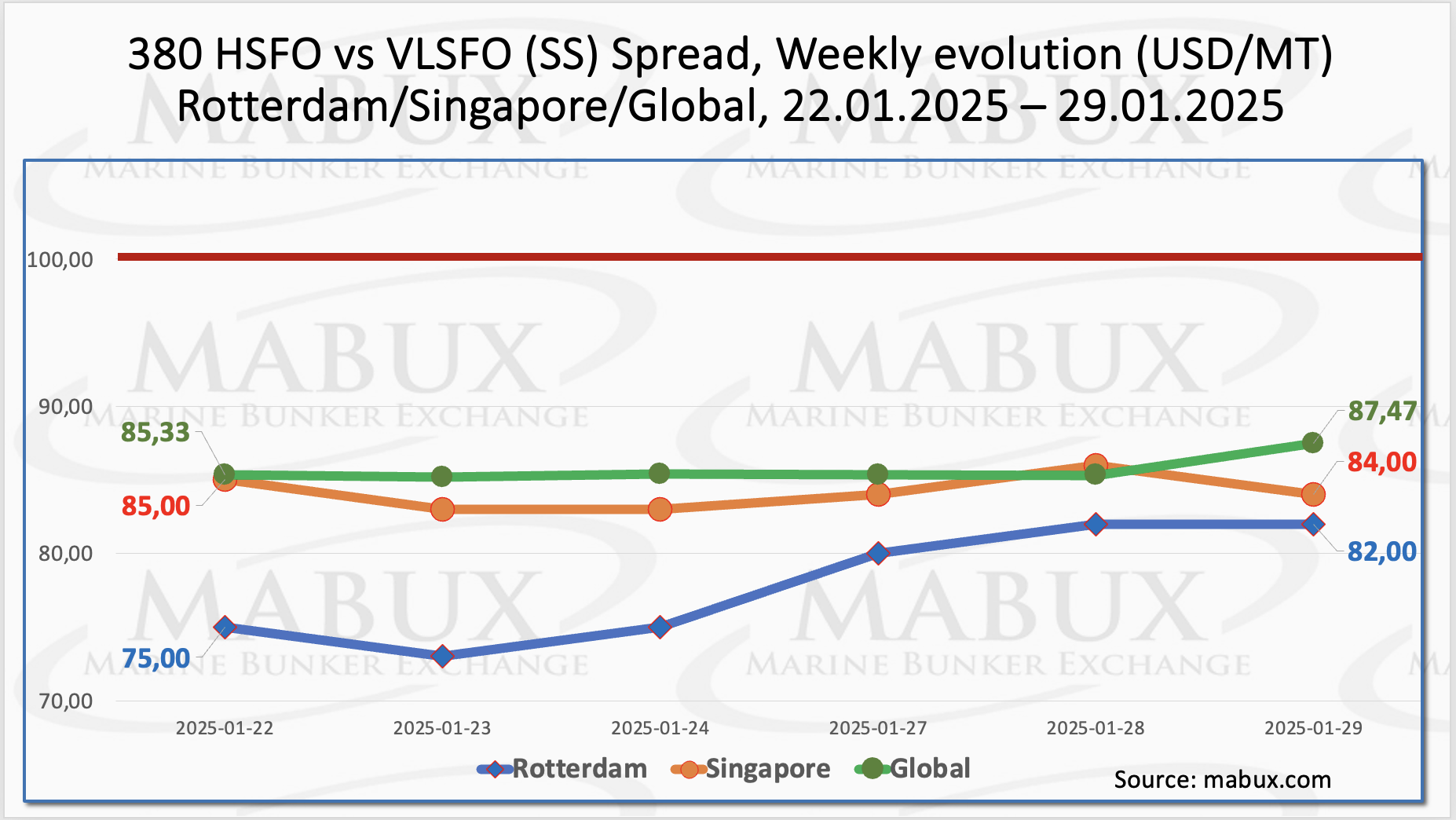

The MABUX Global Scrubber Spread (SS), representing the price difference between 380 HSFO and VLSFO, saw a modest increase of US$2.14 to US$87.47. However, it remained significantly below the US$100 breakeven threshold. In contrast, the index’s weekly average experienced a slight decline of US$1.31.

In Rotterdam, the SS Spread increased by US$7, reaching US$82, while the port’s weekly average dropped by US$2.50. Meanwhile, in Singapore, the 380 HSFO/VLSFO price difference decreased by US$1 to US$84, with the weekly average down by US$6.66.

Overall, no distinct trend emerged in the Global SS Spread or regional indices throughout the week, with values consistently remaining below the US$100.00 mark.

“We anticipate continued irregular fluctuations in the SS Spread next week,” pointed out a MABUX representative.

LNG exports from the United States to Asia are being sharply redirected to Europe, where

gas prices are higher, and demand has surged due to winter weather and the disruption of

pipeline gas supplies through Ukraine. In January, at least seven US LNG tankers originally bound for Asia via the Cape of Good Hope were rerouted in the South Atlantic and are now en route to European LNG terminals. As of 28 January, European regional storage facilities were 55.46% full, reflecting a decline of 3.92% compared to the previous week and 15.87% since the beginning of the year. The gas withdrawal process remains ongoing. At the end of the fifth week of the year, the European gas benchmark TTF dropped by €1.803/MWh, once again falling below the €50/MWh threshold (€48.224/MWh vs. €50.027/MWh last week).

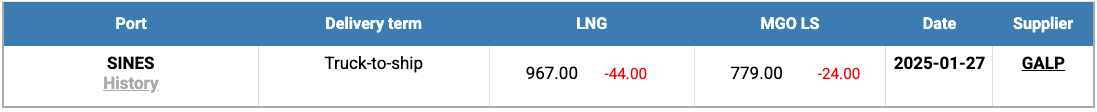

The price of LNG as a bunker fuel in the port of Sines (Portugal) dropped by US$44 over the week, reaching US$967/MT on 27 January. At the same time, the price gap between LNG and conventional fuel narrowed on the same day. MGO LS was priced at US$779/MT in Sines, creating a US$188 advantage for MGO LS, down from the US$209 difference recorded the previous week.

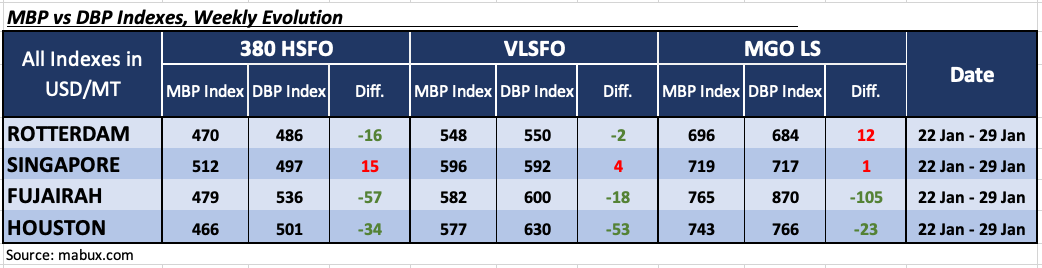

During Week 05, the MABUX Market Differential Index (MDI)—which compares market bunker prices (MBP Index) to the MABUX digital bunker benchmark (DBP Index)—exhibited mixed trends across the four key hubs: Rotterdam, Singapore, Fujairah, and Houston.

- 380 HSFO Segment: Singapore remained the only overvalued port, with its overpricing weekly average increasing by 14 points. In contrast, Rotterdam, Fujairah, and Houston were undervalued, though the degree of undervaluation narrowed by 14, 8, and 7 points, respectively.

- VLSFO Segment: Singapore moved into the overvalued category, with its weekly average rising by 9 points. Meanwhile, Rotterdam, Fujairah, and Houston remained undervalued, with weekly averages decreasing by 14 points in Rotterdam and 9 points in both Fujairah and Houston. Notably, the MDI in Rotterdam and Singapore approached the 100% correlation mark between market prices (MBP) and the MABUX digital bunker benchmark (DBP).

- MGO LS Segment: Both Rotterdam and Singapore entered the overvalued zone, with overpricing indices rising by 17 points in Rotterdam and 6 points in Singapore. Fujairah and Houston continued to be undervalued, with weekly averages declining by 12 and 9 points, respectively. Singapore’s MDI maintained a 100% correlation between MBP and DBP, while Fujairah’s index edged closer to the US$100 mark.

“We expect that, in the absence of clear movers in the global bunker market, the moderate

downward trend in bunker prices will persist next week,” commented Sergey Ivanov, Director of MABUX.

![]()

The post Global bunker indices continue downward trend appeared first on Container News.

Content Original Link:

" target="_blank">