Chinese vessel orderbook tops US$123 billion

Seacon Shipping Group also deserves an honourable mention, ranking second in terms of vessel numbers with 26 new orders placed, which mainly consist of Tanker newbuilding projects,valued at US$738 million.

New building prices are at the highest levels since 2009 due to high steel prices, lack of yard availability and demand. The supply and demand imbalance caused by the Red Sea crisis boosted sentiment and expectations for high earnings. This triggered owners to place orders across the Container, Tanker and LNG sectors.

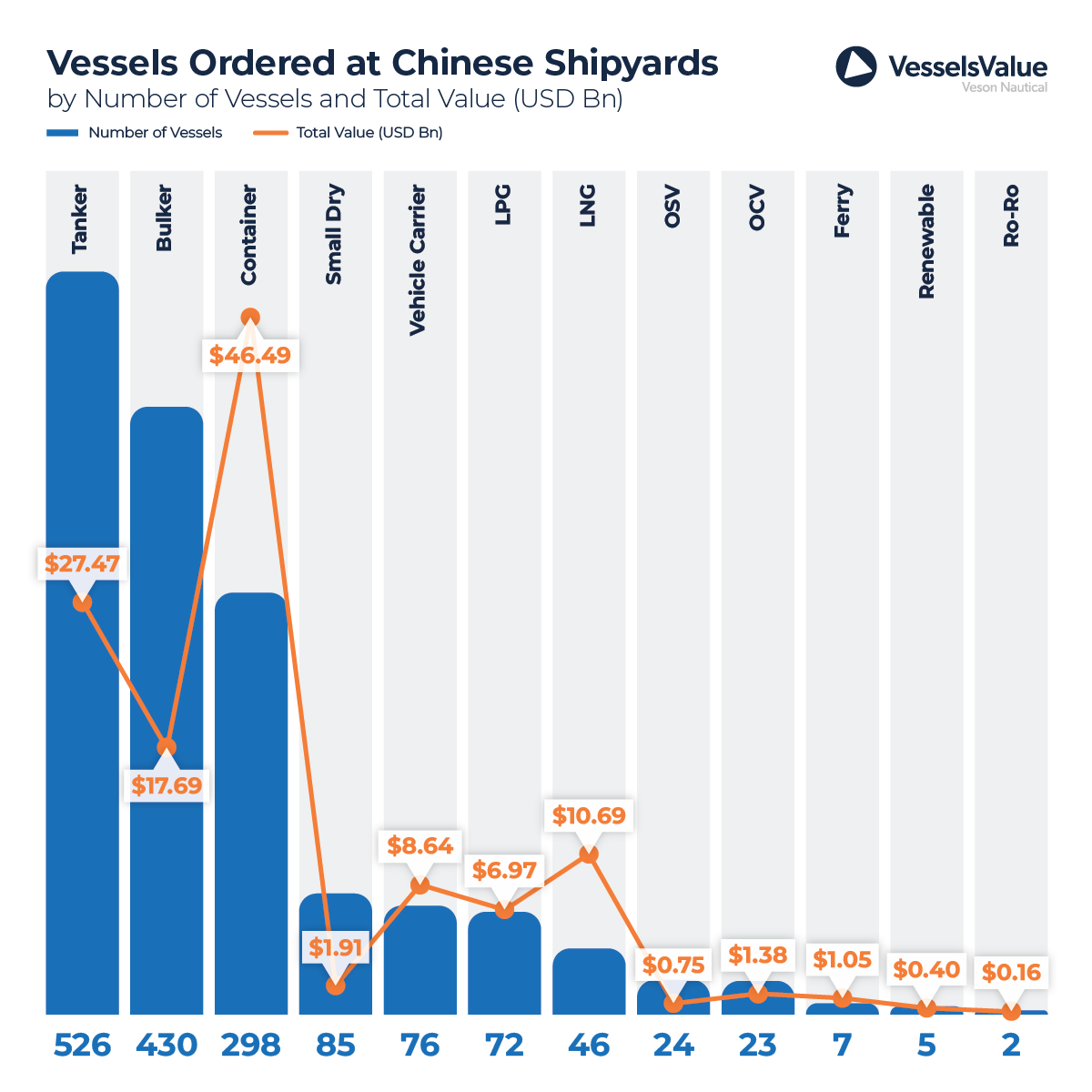

Tankers were the most popular vessel type ordered at Chinese yards in 2024 with 526 new vessels ordered, valued at US$27.4 billion. Throughout 2024, Tanker new building prices were at the highest levels since 2009 due to high steel prices, lack of yard availability, and demand. The supply and demand imbalance caused by the Red Sea crisis boosted sentiment and expectations for high earnings. This triggered owners to place orders across the key sectors i.e. Tankers, Bulkers, and Containers.

In second place was the Bulker sector with 430 new vessels ordered, worth US$17.7 billion. Ranking third in terms of the number of vessels is the Container sector, with 298 new orders placed. However, the value of these orders far exceeds any other sector, worth US$46 billion; this comes as values for this sector saw significant gains over the past year, across all sub-sectors and size ranges.

However, Container new buildings rose the least, making them appealing investments despite the time lag. For example, values for Post Panamax new buildings of 7,000 TEU rose by c.14.45% from US$101.99 mil to US$116.73 million. In contrast, 20 YO Post Panamaxes rose by as much as c.114.99% year-on-year from 20.62 million to US$44.33 million.

Author of the Article: Rebecca Galanopoulos, Senior Content Analyst at Veson Nautical

Content Original Link:

" target="_blank">